Key facts

ProCredit at a glance

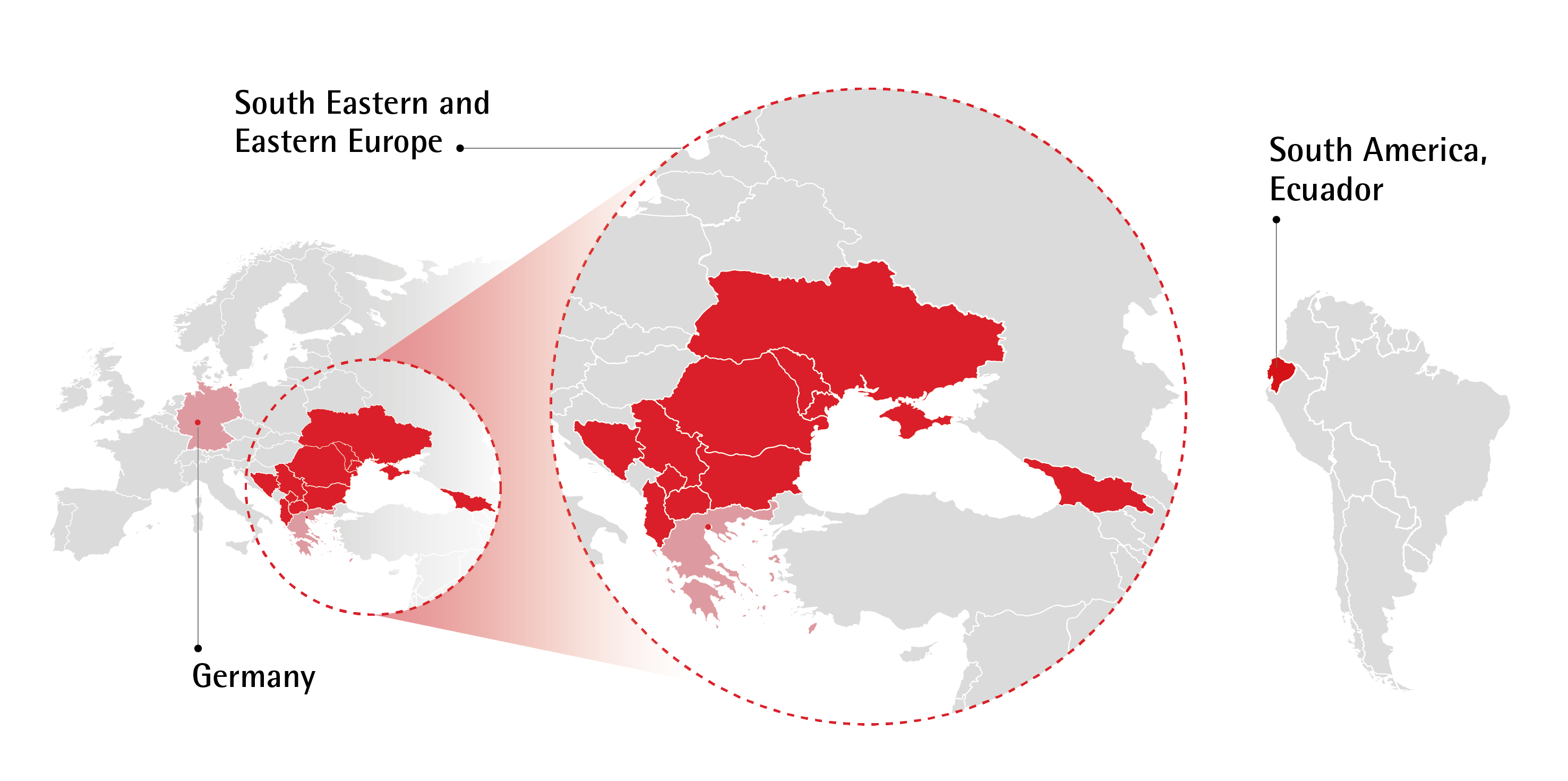

- An impact-oriented group of commercial banks with a focus on MSMEs and Private Clients in South Eastern and Eastern Europe

- “Hausbank” for MSMEs and ProCredit Direct for Private Clients

- Headquartered in Frankfurt and supervised by BaFin and Bundesbank

- Track record of high-quality loan portfolio based on prudent risk management and focus on long-term business relationships

- Profitable every year since creation as a banking group

Our Mission

We strive to be the leading SME bank in our markets following sustainable and impact-oriented banking practices. Together with our fully digital offering to private clients, we want to generate long-term sustainable returns and create positive impact in the economies and societies we work in.

Regional footprint

Group Key Indicators

Statement of Profit or Loss

| (in EUR m) | H1-23 | H1-24 |

| Net interest income | 155.7 | 180.6 |

| Net fee and commission income | 28.9 | 29.3 |

| Other operating income (net) | 7.2 | 9.8 |

| Operating income | 191.8 | 219.7 |

| Personnel expenses | 56.4 | 69.3 |

| Administrative expenses | 58.1 | 71.5 |

| Loss allowance | 0.5 | 5.7 |

| Tax expenses | 12.7 | 15.6 |

| Profit after tax | 64.1 | 57.6 |

Key Performance indicators

| H1-23 | H1-24 | |

| Change in customer loan portfolio | 0.8% | 6.9% |

| Cost-income ratio | 59.7% | 64.1% |

| Return on equity | 14.2% | 11.6% |

| CET1 ratio (fully loaded) | 14.2% | 14.3% |

Additional indicators

| H1-23 | H1-24 | |

| Net interest margin | 3.5% | 3.6% |

| Net write-off ratio | 0.1% | 0.2% |

| Credit impaired loans (Stage 3) | 3.2% | 2.5% |

| Cost of Risk | 2 bps | 18 bps |

| Stage 3 loans coverage ratio | 62.4% | 55.6% |

| Book value per share (EUR) | 15.9 | 17.1 |

| Deposit-to-loan-ratio | 104.9% | 113.4% |

Ratings

| FitchRatings | Long term rating (outlook) | BBB (stable) |

| MSCI ESG Research | ESG rating | A |

| ISS ESG | Corporate rating | Prime |